In lieu of a clever poem, we’ll turn on a re-run of the Grinch and call it good. As we wind down a traditionally quiet week of market activity heading into the Christmas holiday, we’re not quite ready to admit that 2016 is almost finished. Time flies when you’re having fun, as the saying goes.

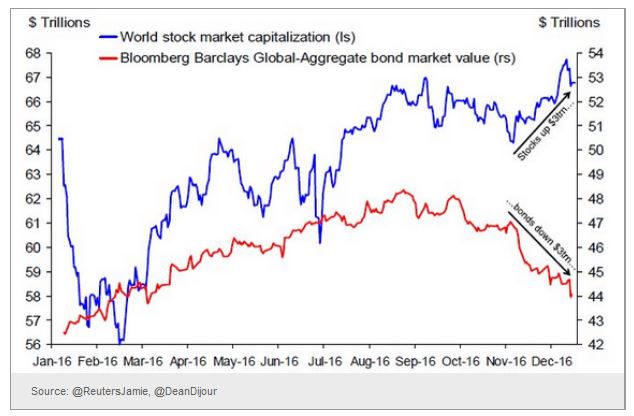

As the Trump trade continues, it’s interesting to see that results are just as polarized as the U.S. voting population. While risk-seeking investors (certainly sector/industry dependent) have been handsomely rewarded during the rotation from bonds to stocks, the conservative investors (read: those who are more heavily invested in bonds) have been punished:

(Source: The Daily Shot)

So as stocks have gained $3 trillion in market capitalization, the global bond market has lost about the same amount. The Santa Claus Rally doesn’t feel so jolly to those invested in fixed income… certainly those in retirement, or managing pensions, or even in a traditional long-term 60/40 portfolio.

The anticipation of higher inflation, improved growth, tax cuts, regulatory roll-back, infrastructure spending, rising rates, and a Partridge in a Pear Tree have all pushed equities higher and bond prices lower. As we write this on Christmas Eve-eve, the Trump trade looks tired, but even the fading momentum could draw in cash from the sidelines. Asset allocations and investment committees may take longer to shift gears, so there’s a chance that January may see continued buying.

But do we have a post-factual political regime here or are things looking up for the economy? The market is forward-looking so expectations are being priced in, but we’ve always been careful not to lean too far forward (for fear of falling on our faces).

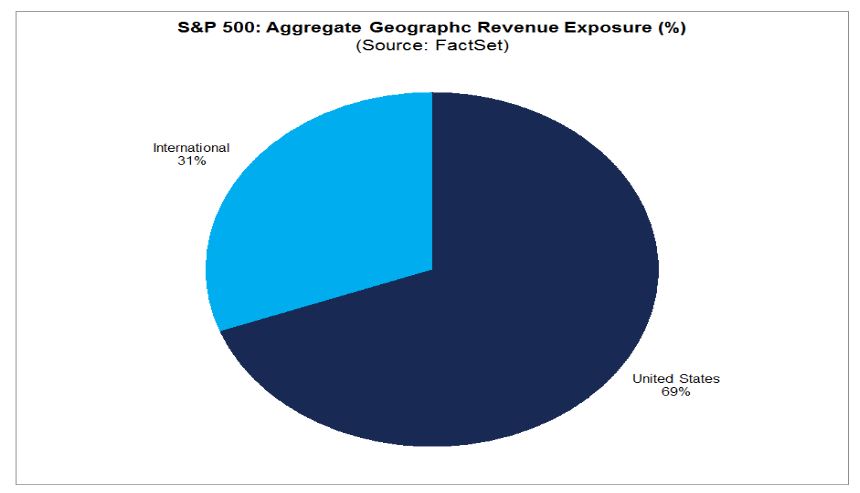

A common talking point since the election has been the strength of the U.S. Dollar. It’s an interesting discussion from the perspective of multinational corporate profits, the price of oil, and the buying power of the U.S. consumer.

(Source: FactSet)

With nearly a third of revenue derived from international geographies, a stronger dollar poses some headwind to the S&P. When you break it down by sector, the effects are more pronounced:

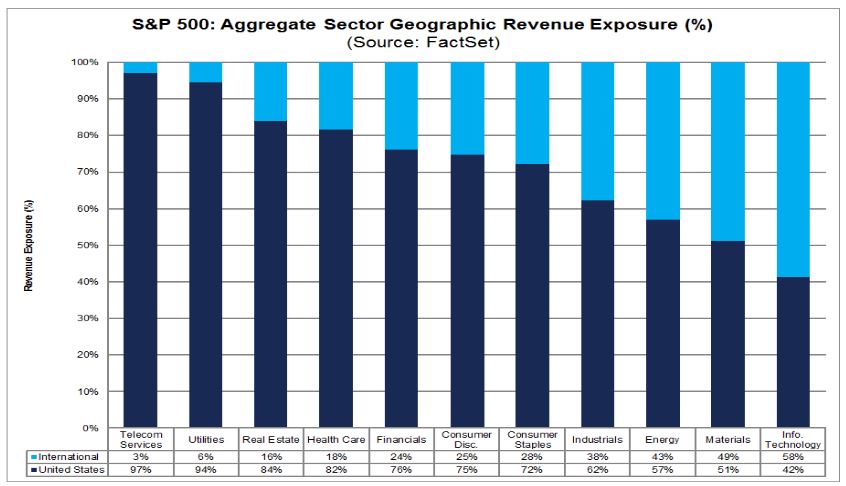

(Source: FactSet)

The technology sector’s revenues come primarily from overseas, and the materials sector is an even split. Speaking of technology, as wage pressure increases, could investment in tech-driven productivity efficiency create favorable conditions for the sector?

(Source: Atlanta Fed)

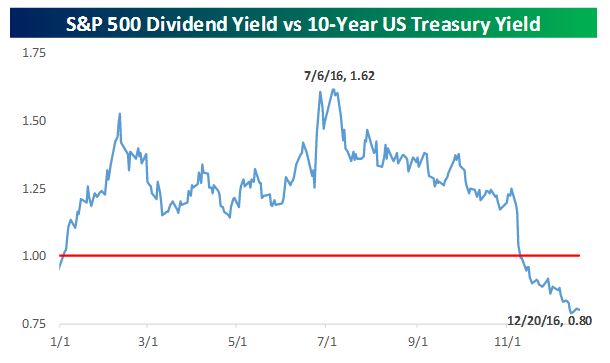

As bond yields ratchet up, we may see the dividend-seeking equity investment thesis challenged:

(Source: Bespoke Premium)

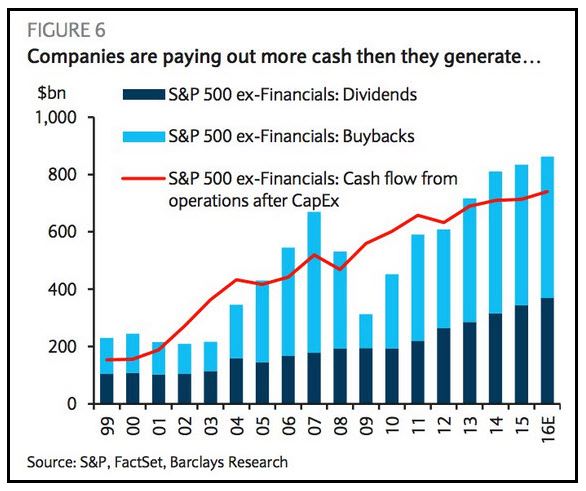

Additionally, funding buybacks and dividends may become problematic, especially as the cost of credit increases:

(Source: 361 Capital)

Moving to the housing market, mortgage rates have skyrocketed as growth and inflation expectations have continued to influence rates (not to mention the Fed’s lifting of rates by 25 basis points):

(Source: Financial Times, @FastFT)

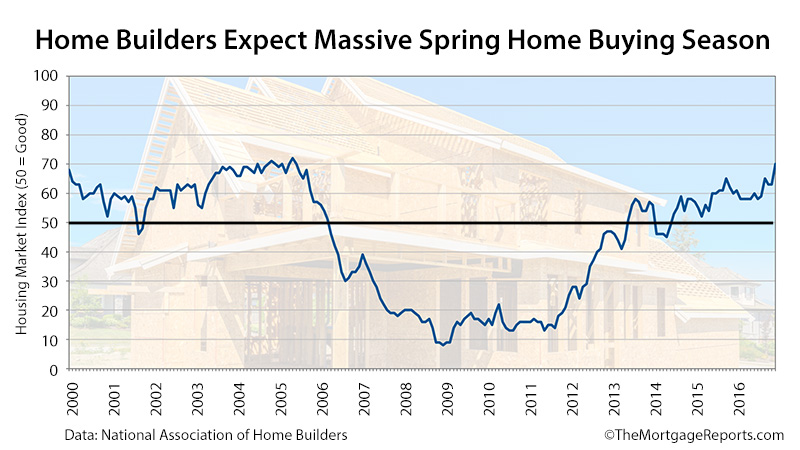

As one of the bright spots of the economy, it will be interesting to see how mortgage rates spill over into consumer spending and how long home builder optimism will last:

(Source: The Mortgage Reports)

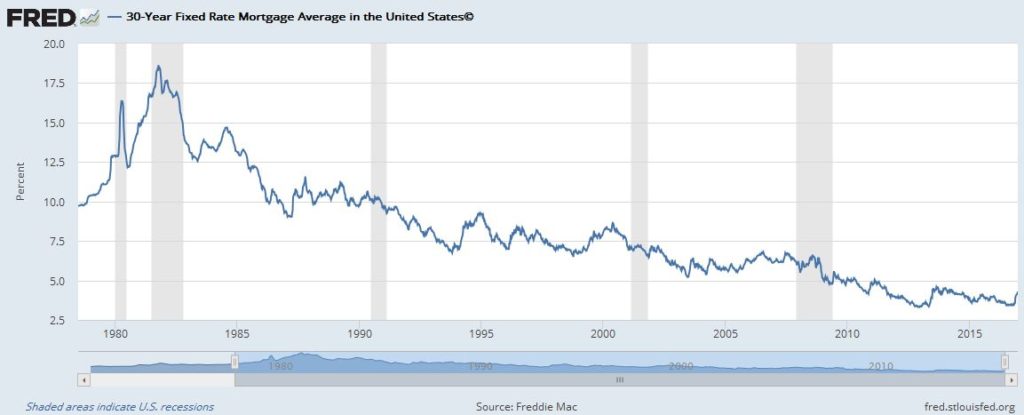

The counterpoint to rising rates is the historical perspective:

(Source: St. Louis Fed)

Even with that small uptick at the end of the series, the 30-Year Fixed Rate Mortgage is still very attractive relative to previous decades

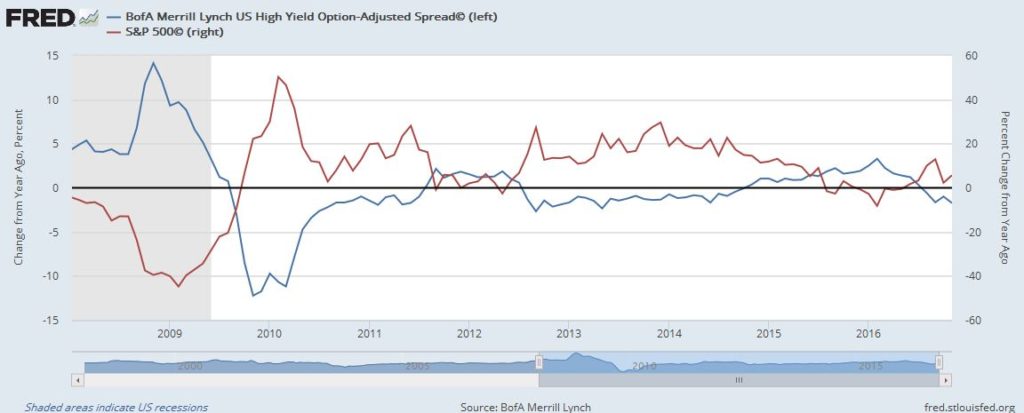

High yield credit spreads still show signs of compressing, indicating a continuing appetite for risk assets. When compared against the S&P 500 (on a percent change from a year ago basis), you can see the turning points of equity returns as high yield spreads (the blue line) “turned upward”… that is, as spreads widen equities tend to experience a lagged worsening performance:

(Source: St. Louis Fed)

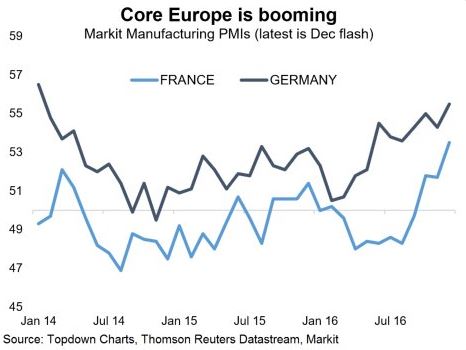

Meanwhile, things in Europe are picking up from a manufacturing perspective… perhaps due to currency impacts (weaker Euro = more attractive exports):

(Source: Topdown Charts)

SO…

Why the play on words in the title? On the surface (and in some places under the hood), market and economic attributes look healthy… perhaps even far from weak. While we’re not ready to make our 2017 predictions (who reads those anyway?), we think the weakness lies in the political and macroeconomic arenas, as well as behavioral/cognitive biases. While the markets seem fixated on Mr. Trump’s tax cut plans, infrastructure spending promises, and deregulation emphasis, it has only been recently that the negative impacts of his proposed trade policies (and administration appointments) and immigration plans have caught the attention of a few folks. And therein lies a perfectly illustrated cognitive bias: the focusing effect. We’ve anchored our outcomes (either positive or negative) on Mr. Trump’s efficacy in office. What about a Chinese hard landing as a result of its debt? Or U.S./NATO/Russian relations and spillovers from operations in and around Syria? Or Russian-Turkish relations? Or counterparty risk in European banking? Or EU dissolution?

The point is that, broadly speaking, we believe 2017 will place more importance on realpolitik and less emphasis on Central Banks. With that said, we believe there’s an element of Central Bank certainty that’s been removed from the market — presumably replaced by uncertainty. One can only hope that 2017 sees more growth and less Grinch.

And with that, Merry Christmas to all — and to all a good night!

—

Mention of products, providers, or services does not constitute an endorsement or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.