You’ve probably seen various headlines and articles that contained some play on the phrase “The king is dead, long live the king.” Things like “The 60/40 portfolio is dead, long live the 60/40 portfolio” have shown up in recent years to indicate either that reports of a particular strategy’s death are greatly exaggerated, or that the debate over a strategy’s performance shifts between belief and doubt frequently.

We’re particularly fond of an article from Bloomberg entitled “The Reflation Trade is Dead, Long Live the Reflation Trade.“

If you’re not familiar with the notion of the reflation trade, you don’t have to look much further than the talk of growth, inflationary pressures, fiscal stimulus, tax reform, and regulatory roll-back that have been persistent since Mr. Trump’s election. The idea is that the growth engine is about to shift into higher gear, so investors should dump bonds and buy stocks that stand to enjoy a more robust growth regime. Pile into small cap value and call it good. Find your favorite cyclical theme and push your chips all-in. After all, global growth is finally going to get a jump start.

Back in March, the aforementioned Bloomberg article referenced a piece of Citigroup analysis that focused on three components of the reflationary environment: oil, iron ore, and copper. The crux of the analysis is that if real demand for these raw materials continues to show strength, then arguments for the reflationary environment (and global growth) remain valid. A crossing below of Citi’s lines in the sand ($47 a barrel for oil, $80 per metric ton for iron ore, and $5,500 for 3-month delivery of copper) would be reason to doubt the reflation narrative.

Now, this is a pretty simplistic view of a complex interconnected issue. But let’s take a look at a few points:

- As we write this, oil has surged over 3% on inventory data and is trading around $47.30

- The April 30th spot price for iron ore came in at 70.22

- 3-month delivery of copper is sitting right around $5,520

On the face of this information, the argument for the reflation trade seems pretty weak. But there’s a good bit of noise in price action, especially when you attempt to extract a signal for demand within the real economy. Fortunately, we can use a few other data points.

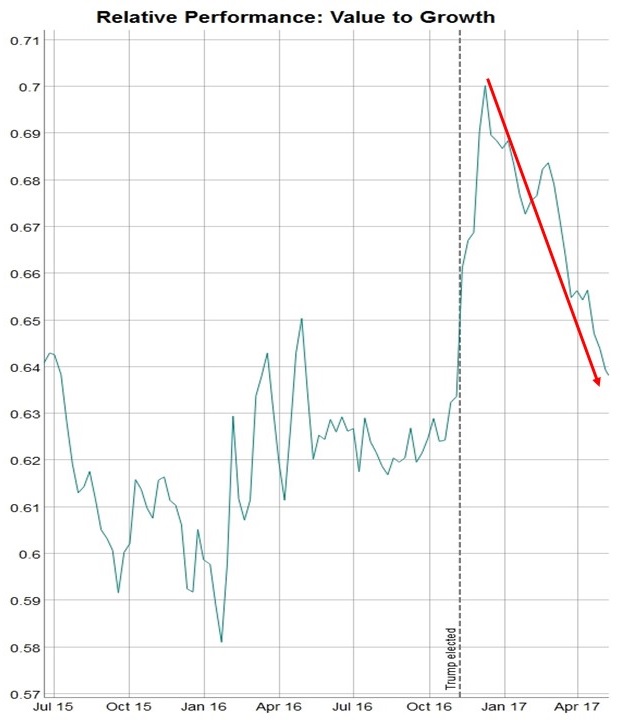

If we look at a proxy of defensive investment performance, we can see that value has been under-performing growth since about December of 2016 (a declining series indicates that growth is outperforming):

(Source: Targeted Wealth Solutions; S&P Pure Value proxied by ETF ticker RPV; S&P Pure Growth proxied by ETF ticker RPG)

You can see that growth had been outperforming value on a relative basis up until the energy and credit markets stabilized in early 2016. Additionally, the talk of global recession faded and prospects of renewed growth really brought “reflation” investments into the limelight. We don’t have to tell you this if you held on to small cap value exposure through 2016 — a 24.9% compound annual growth rate in the Vanguard Small Cap Value (VBR) ETF is sufficient to remind you.

But then a funny thing happened on the way to inflation, fiscal stimulus, and higher rates. Investors rotated into growth stocks in December and haven’t looked back. This raises the obvious question: If we’re stoking the fires of global growth, then why are investors leaving the reflation bandwagon?

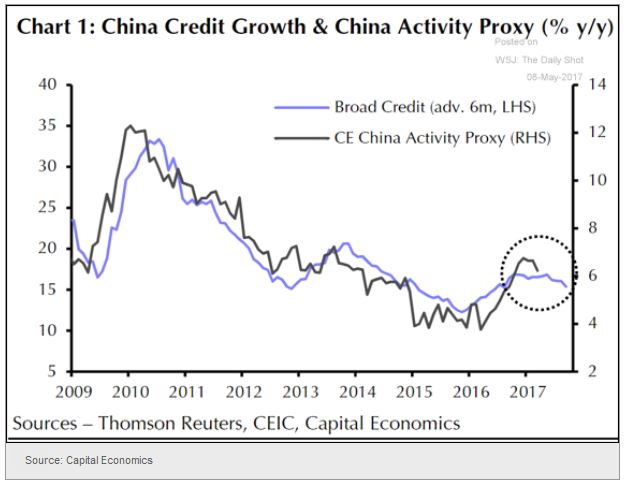

Certainly one argument we’ve heard is that China’s stimulus injection in 2016 helped the reflation trade… but is now fading as the country attempts to balance debt against growth prospects. A few indicators point to this fade:

(Source: The Daily Shot)

There’s an obvious plateau in credit in the above chart, but the question remains whether broad economic activity in China will smoothly decelerate or undershoot as other systemic headwinds show up. There’s still a good bit of debt to service in China…

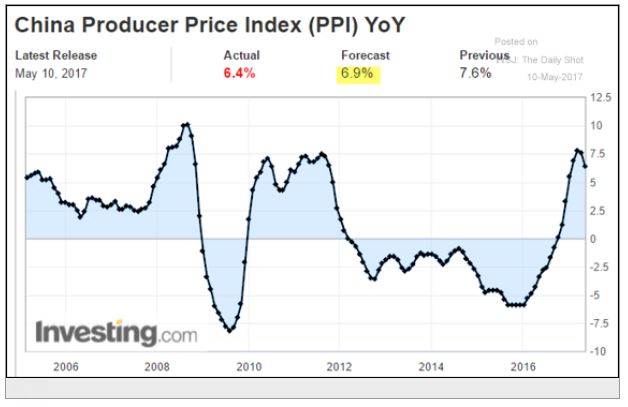

As far as the Producer Price Index is concerned, it seems to have rolled over…

(Source: The Daily Shot)

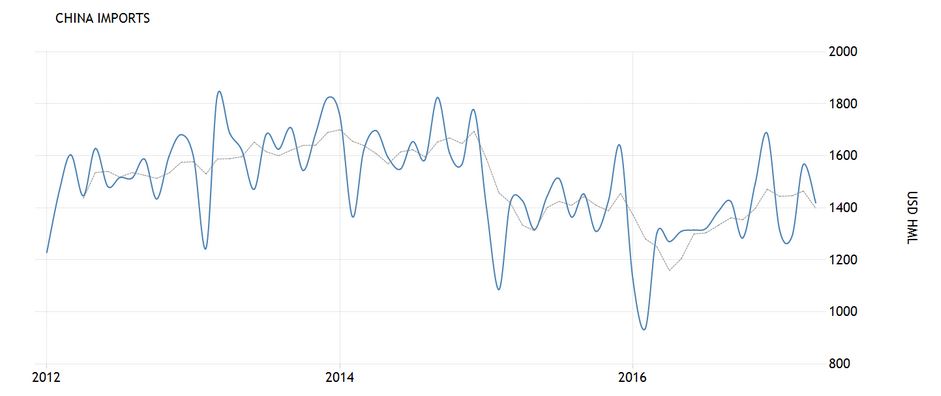

As China’s demand for imports dries up, there will be an inevitable knock-on effect on global manufacturing. A 4-month average (light gray line) of imports shows a turning trend:

(Source: Trading Economics)

It remains to be seen how much fiscal stimulus can offset the tightening conditions in China.

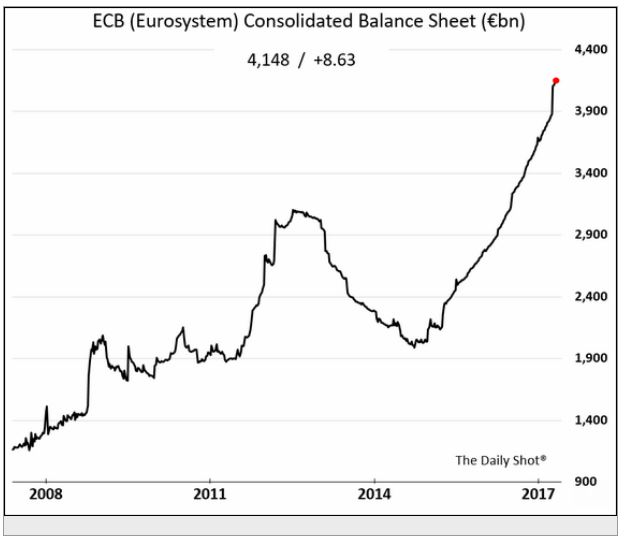

Looking across the Atlantic, the ECB balance sheet continues to grow despite improved sentiment across the region:

(Source: The Daily Shot)

With Eurozone Industrial Production slumping recently, perhaps it’s best to keep the stimulus lifeline going…

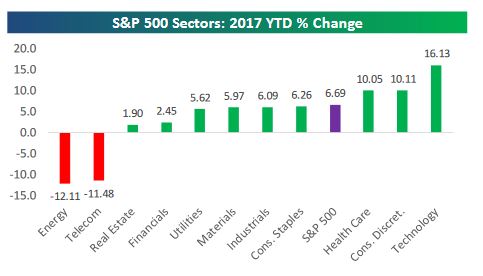

On the sector level here in the U.S., it’s interesting to compare YTD performance based on where you think we are in the business cycle and the impact of fiscal stimulus alongside monetary tightening:

(Source: Bespoke Premium)

With June rate hike expectations priced in at 100% probability, it looks like interest rates are going to head a little higher next month. The resulting impacts on real activity and growth will play out over the course of the year… given the geopolitical backdrop and drama in the White House, we suspect the remainder of 2017 will be interesting.

—

Mention of products, providers, or services does not constitute an endorsement, recommendation, or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.