Despite the recent snow along the Front Range here in Colorado, you can’t deny that spring is here. And with spring comes graduations. From preschool to high school, students will march down the aisle to celebrate past progress and future plans. We don’t remember much about graduations, but our pictures tell us everything we need to know: Bowl cuts never looked good on us and we probably could’ve come up with something clever to put on the top of our mortarboards. “Game of Loans” is still one of our favorites, along with the classic “Hire me.”

Before parents can enjoy the kind of mortarboard creativity that comes with a college degree, however, there’s still the daunting prospect of actually paying for higher education while saving for retirement… and simply covering living expenses.

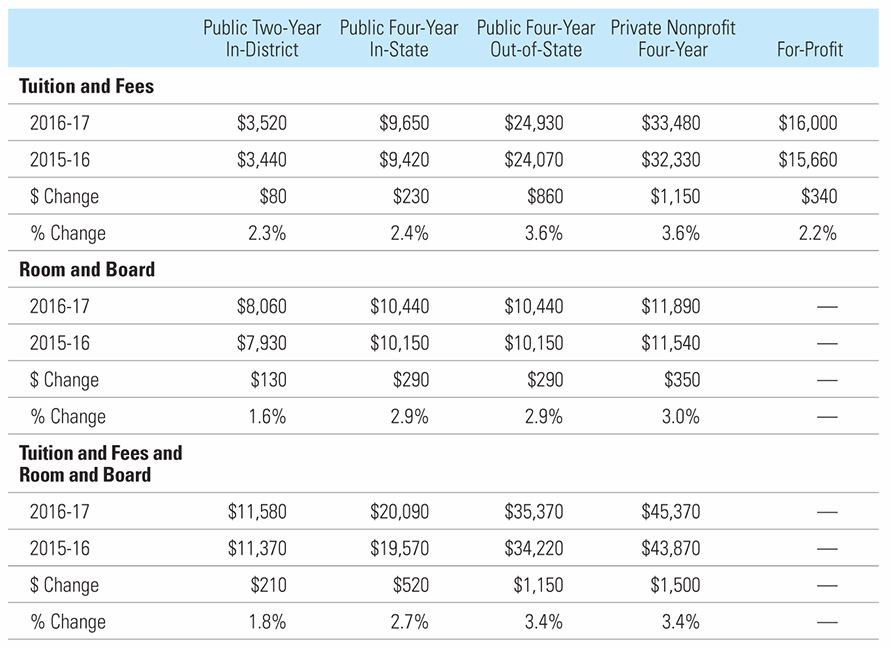

This article covers some of the funding and savings options that families have to help pay for higher education. Before we get started, here’s the latest data from the College Board regarding the cost of college:

(Source: CollegeBoard.org)

You can pick your favorite measure of inflation (ours happens to be the Atlanta Fed’s modeled Sticky-Price CPI, but that’s a story for a different time) and you can see that education expenses — especially the out-of-state and private costs — have increased by a larger margin than baseline consumer inflation.

Fast-forward that inflated education expense to when your student is expected to enter college and you can see where sticker shock comes into play. What about multiple students? Should you just give up, move to a tiny house, and abandon any hope of helping pay for higher education? Well, unless you really like the idea of living off the grid in a miniature cottage, we think there are some strategies to help you conquer the college beast.

First and foremost, you need to have the talk with your student. The one where you all roll up your sleeves and talk candidly about personal finance, schools, and the true cost of college. Going into the college search process with well-developed and realistic expectations will result in a much better outcome for everyone.

Planning for higher education boils down to a five-pillared process:

- A discussion about financial planning and household resources between you and your student

- A methodical and realistic school search and prioritization

- An understanding of need-based and merit-based financial aid available to your student (including the timelines and requirements)

- A discussion with a tax professional over strategies available to maximize benefits

- A plan for using investments and current income to cover expenses… without ruining your retirement gameplan

So let’s discuss some of the savings vehicles available to you. You’ve probably heard of the 529 College Savings Plan, but do you know if a 529 is right for you?

What is a 529 College Saving Plan?

From the U.S. Securities and Exchange Commission: “A 529 plan is a tax-advantaged savings plan designed to encourage saving for future college costs. 529 plans, legally known as ‘qualified tuition plans,’ are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code.”

There are no income or contribution limits for 529 plan. And if someone wants to give a gift to the plan, there’s even a “5-year election” option that allows for a lump-sum contribution equal to five times the annual gift tax exclusion (that’s worth 5 x $14,000, or $70,000, in 2017).

Taxes

Generally speaking, you can think of a 529 plan like a Roth IRA for education purposes. The money you invest has already been taxed as normal income, and it can now grow tax-free as long as you spend it on qualified education expenses. In addition, over 30 states currently offer some sort of tax deduction or credit for contributions you make to 529 plans. We recommend SavingForCollege.com as a good starting point for benefit calculations and tax break information.

Tax Savings

There is no immediate federal tax benefit, although investments do grow tax free if used for qualified education expenses. Additionally, states have various residency and or plan requirements to meet before you get a benefit on your tax return.

Here’s an example: Pennsylvania, one of the most flexible states for tax savings, has a state income tax rate of about 3%. Pennsylvania will allow 529 plan contributors to deduct $14,000 annually. This could save investors just over $400 a year in taxes.

529 Plan Expenses

When looking at a 529 plan you may see the following fees listed: program manager fees, state fees, annual distribution fees, total annual asset-based fees, account maintenance fees, and miscellaneous fees. These fees vary between states and plans, so be sure you understand the “all-in” cost of a plan. Remember, you may not be able to control the market, but you can certainly control the costs.

What if you don’t use your 529 plan for “qualified education expenses?” In this case, you will be required to pay federal taxes on any earnings, a 10% federal tax penalty, and possibly be required to repay state taxes. Currently, tuition, room and board (up to the college’s estimate if living off campus), technology items, books, and required supplies are all listed as qualified expenses. Before you pay for anything out of the 529 plan, however, we recommend speaking to your advisor, CPA, or reviewing the up-to-date IRS guidelines.

Other Ways to Save

529 plans aren’t the only way to save for college. Here are three other vehicles and some of their associated pros and cons.

CESA (Coverdale Education Savings Account)

PROS: Broad investment choices to reduce fees and good tax benefits

CONS: Low contribution limits

UGMA/UTMA (Uniform Gift to Minors Act / Uniform Transfer to Minors Act)

PROS: Broad investment choices and unlimited contribution limits

CONS: Limited parental control of the funds, somewhat complex tax rules, and poor financial aid treatment

Taxable accounts

PROS: Unlimited investment choices, no contribution limits, unlimited parental control, and good financial aid treatment (the parent retains ownership of the account)

CONS: No tax benefit

What Next?

College planning is a deliberate process, from finding the right school to finding the right way to pay for it. In fact, Morningstar just put out a good article on sequencing your assets… you can read it here. You may notice some common threads: First, every family’s situation is unique; and second, kicking your student out of the door and into higher education requires some rigor to the approach.

In the meantime, however, we wish our recent graduates the best of luck and a great summer!

—

Mention of products, providers, or services does not constitute an endorsement, recommendation, or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.