As we prepare to fry the turkey (safely, mind you) and join together with family and friends to celebrate the blessings of the year, we’re inevitably reminded of the needs of others. Targeted Wealth Solutions recently helped provide reusable food collection bags for the Erie Community Food Bank in an effort to streamline neighborhood food collections. The results have been impressive thanks to local volunteers and generous supporters who have donated so much that the Food Bank is running out of space. It’s a good problem to have, and it represents the heart of the season — thankful giving out of the bounty of our blessings.

As the end of the year approaches, many people begin asking questions about charitable giving in the context of a good run of investment gains or larger-than-expected household income. We wanted to share a little insight into methods by which investors can gift appreciated assets or manage distributions to qualified charities on an ongoing basis.

First and foremost, all charities aren’t created equal. There are 29 types of nonprofits within the tax code, and you may need to do a little research to see whether your gift to a particular nonprofit is eligible for a charitable contribution deduction. You can always call and ask the organization directly, or you can swing by a site like Charity Navigator to do research on a charity and see if it qualifies for a deduction. As of November 22, 2017, Charity Navigator indicates that “all organizations rated by Charity Navigator qualify for charitable status, and you can deduct your donations to these organizations, subject to certain limitations.”

We like Charity Navigator because it allows you to easily research the mission and financial stewardship of charities.

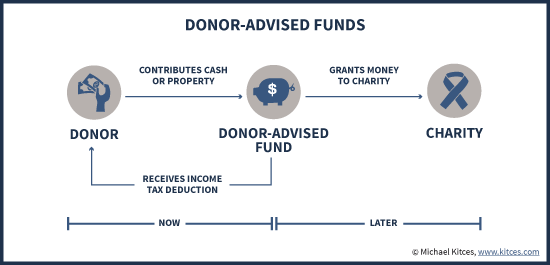

Donor-Advised Funds (DAF)

The DAF has grown in popularity over the last decade and probably with good reason. With a DAF, a donor receives an immediate tax deduction for the charitable gift even though the gift doesn’t have to be distributed to a beneficiary during that same year. Said another way, donor-advised funds provide an immediate tax benefit even if you haven’t made up your mind as to where you want your donation to go. These attributes — paired with the ease of online donations and beneficiary management — have made DAFs a go-to solution for philanthropy. As The Economist reported in May 2017:

The industry has since ballooned: from about 180,000 American DAFs in 2010 to over 270,000 in 2015, easily outnumbering foundations. The assets held in DAFs doubled in value in that time, to roughly $80bn.

And DAFs aren’t just offered by little-known firms scattered throughout the country. Fidelity Charitable is the largest provider, and Vanguard and Schwab are in the mix as well. When you consider the benefits of recognizing a charitable deduction and having discretion on how your donation is given to various charities (not to mention how the balance remains invested as you wait to make a donation), it’s not surprising that DAFs have grown in size and popularity.

Some donor-advised funds can accept appreciated investments and illiquid securities, which may require an independent appraisal to determine the fair market value. The tax deduction of non-cash gifts is also less than if you had donated cash, although you can carry forward contributions above the limit based on your Adjusted Gross Income. In other words, make sure you’re speaking with your CPA to get the proverbial ducks in a row.

(Source: Michael Kitces)

Big Income Years

While you may equate big income years with a bonus or some other sort of one-off variable compensation, you can also run into larger-than-expected income if you convert a Traditional IRA into a Roth IRA. Since Traditional IRAs (perhaps from a 401(k) rollover) are funded with pre-tax dollars, you’ll be required to pay taxes on those contributions during the conversion to a Roth IRA. While executing this strategy during a low-income year is a common recommendation, the bump in income can also be mitigated with a donation to a DAF.

The Bottom Line

Researching local, domestic, and international charities is a good place to start when you find yourself contemplating charitable giving. From there, you can give directly or utilize a conduit like a donor-advised fund to facilitate giving. Maybe you want to donate your time instead. VolunteerMatch is a place to start if you’re looking for a way to contribute your time, although your city or town’s webpage may list volunteer opportunities that could make an impact in your community. Your church or social club may also have some opportunities.

Warm wishes for a Happy Thanksgiving!

—

Mention of products, providers, or services does not constitute an endorsement, recommendation, or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.