Since the week of February 15th, the S&P 500 has only had two down weeks; in fact, the resilience of this market continues to impress us as we sort through the economic data and underwhelming earnings reports. However, the one thing that continues to be missing is the individual investor. Despite the S&P 500 pushing toward all-time highs, sentiment continues to be underwhelming among individual investors. This week’s American Association of Individual Investors Sentiment Survey highlights just this:

(Source: AAII)

The AAII points out that the long-term Bullish Sentiment average is 38.6%, the Bearish Sentiment average is 30.3%, and the Neutral average is 31.1%

As the fine folks at Bespoke Premium point out, the continued downward trend of individual investor sentiment (lower highs and lower lows) has persisted since late 2014. Even given the most remarkable quarterly “come back” in market history, improving global economic outlook, and rebounding oil prices, bullish sentiment remains stubbornly low:

(Source: Bespoke Premium)

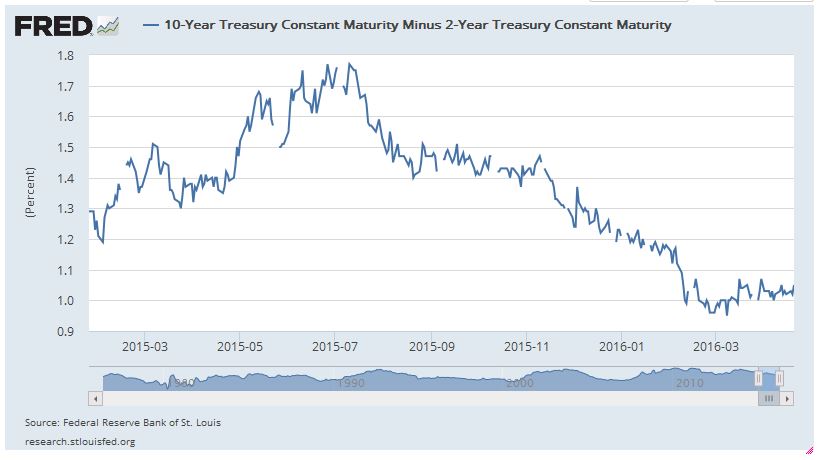

The case for improved sentiment has certainly been growing since the first part of the year. High yield spreads have collapsed, indicating that investors believe in an improvement in the junk market’s collective balance sheets. Additionally, the spread between the 10-year U.S. Treasury and the 2-year U.S. Treasury has slowly climbed from its decade low earlier this year. This is typically viewed as a positive expectation for stable or improving economic conditions.

(Source: St. Louis FRED Economic Research)

However, if you look at the high yield spread through a relative lens, perhaps things look less rosy:

(Source: St. Louis FRED Economic Research)

While we saw a spike in the spread leading into 2012, the level is still appreciably higher than the expansionary years leading into a recession. The increasing numbers of corporate defaults isn’t helping the sentiment case, either:

High yield bond issuance has fallen to half of its 2015 levels, and the Financial Times (via an interview with UBS’ credit strategy arm) recently highlighted the growing concern of companies with low credit ratings and the eventual need to refinance their debt. S&P increased their list of “weakest link” companies (those with the highest risk of default) at the end of march to 242 — the highest level since 2009.

As consumers continue to save more and spend less, prospects for a robust consumption-fueled surge in GDP growth continue to fade. Currently, the personal saving rate sits at 5.4%, matching its highest level since 2012. This week was pretty dismal for U.S. macroeconomic data — housing starts and sales failed to impress, the Philly Fed Business Outlook missed expectations significantly, and the Flash PMI missed consensus expectations as well (although it was barely above the magic 50 mark).

With the risks skewed to the downside and the market seemingly caught in a year-long trading range, we can understand why individual investor sentiment remains muted — even with the recent impressive rally. In a depressed rate environment, investors may be unwilling to bear the duration risk of longer dated bonds; conversely, loading up on high dividend-paying equities may not be prudent on a risk-adjusted basis. Perhaps individual investors — still spooked after the tech bubble and global financial crisis — don’t want to be last one standing when the music stops this time.

—

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.