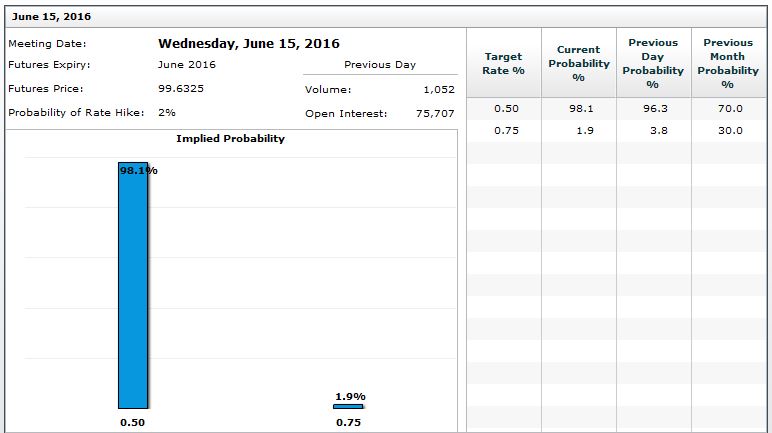

While it was tempting to comment on June 3rd’s dismal U.S. employment situation report last week, we wanted to wait on this week’s data from the labor market conditions index, productivity, and job openings reports. In the meantime, however, the market effectively took a June rate hike off the table… and most likely a July move as well:

(Source: CME Group)

Last month — as the chart points out — the probability was standing around 30% for a 25 bps (.25%) rate hike. As we pointed out in May, June was looking like a little too soon given the recent soft manufacturing data and too-close-to-call Brexit poll results. As such, July became the market’s preferred month, especially after Chair Yellen gave her “slow and steady” commentary on the subject of rate normalization among mixed economic data. We pointed out before Memorial Day that July was looking like the winner, as its market-implied probability of a rate increase was as high as it was before the market turmoil at the beginning of the year.

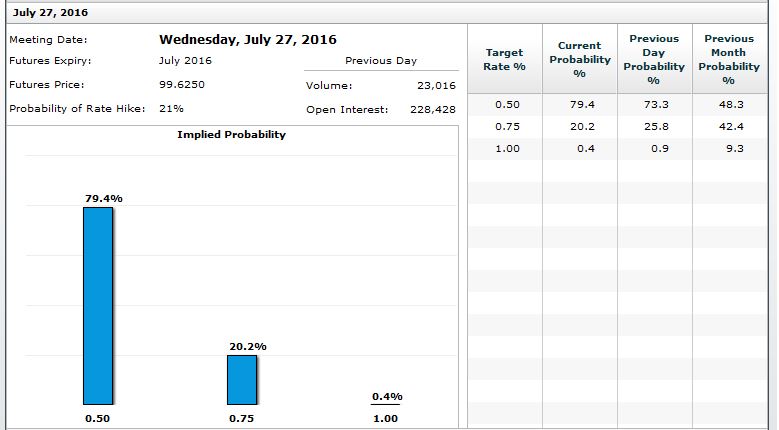

However, July’s odds have also fallen:

(Source: CME Group)

This week’s data largely corroborated the weakness in the labor market that showed up last week. The labor market conditions index (a product of Fed economists to gauge several indicators of labor market indicators) continued to soften against its recent post-crisis peak in December 2015. We’ve included two charts for your consideration. The first is the simple plot of the index as it is released. The second comes from Advisor Perspectives, and is a calculation of the cumulative value of the index. The take-away is pretty interesting:

(Note: We’ve also included some text from the Advisor Perspectives article explaining the chart):

(Source: Advisor Perspectives)

Productivity continues to underwhelm here in the U.S.:

Temporary help hiring — a closely-watched “canary in the coal mine” that some say presages recessionary conditions — continues to head downhill:

And the skills gap here in the U.S. weighs on hiring activity and job openings. Could it be time to go back to school?:

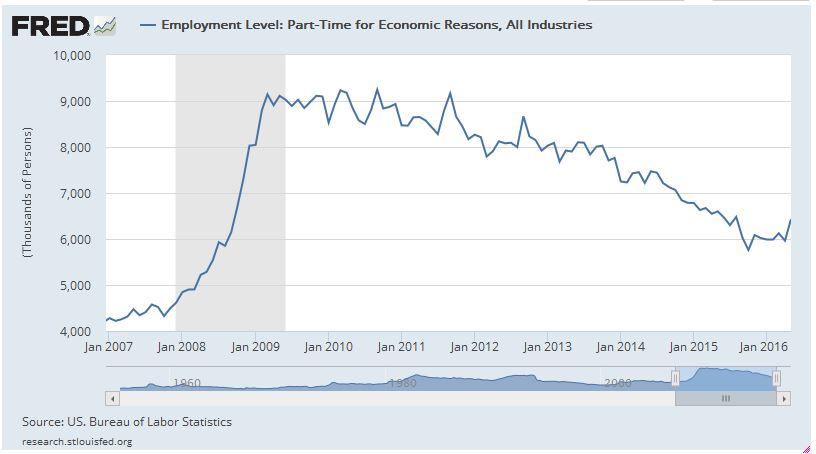

Folks working part-time for economic reasons appeared to reach a lower-bound last fall, but has since increased:

The bond market isn’t buying the economic growth story, however, as the U.S. 10-Year rate minus the 2-Year rate continues to plumb recent lows (constant maturity, monthly data):

While housing remains a bright spot, wages are increasing (although this will probably put pressure on corporate margins), inventories showed an impressive jump, and a few weekly leading economic indicators are showing positive, the data remain mixed and weak on the whole. However, if June payrolls come in at a strong level — indicating that May was an aberration — July could potentially be back on the table for a rate hike, especially if inflation stays within the 2% target and the data shift slightly positive. We believe that this would be within the realm of “positive forces” that Chair Yellen mentioned recently. However, we suspect that the Fed may feel limited by the time that it will have to telegraph its intentions — choosing to avoid ushering in a mild market panic attack.

Also, with Brexit around the corner, we can’t blame the Fed for taking the summer off. A recent poll by The Independent in Britain showed that 55% of voters in the “Exit” camp. However, the polls remain too-close-to-call, and volatility in the Pound and in developed Europe reflect the uncertainty. Speaking of the Eurozone, The Financial Times reports that 15% of corporate debt has a negative yield. Money for nothin’, as Dire Straits would say.

(Source: @fastFT)

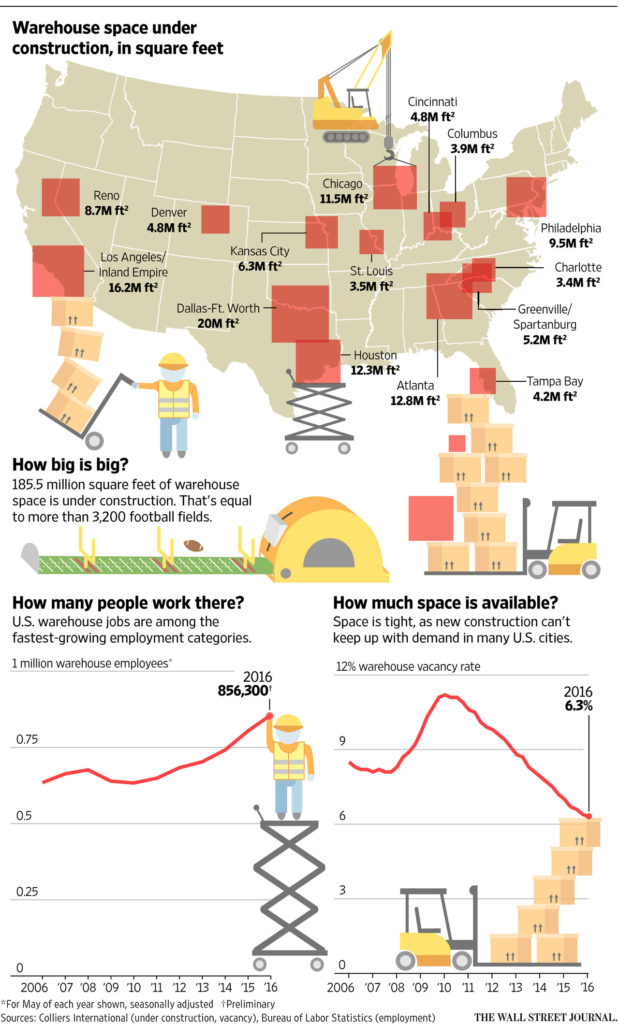

Finally, some food for thought. The Wall Street Journal ran a short bit on warehouse capacity and geography here in the U.S. If you’ve often wondered where your Amazon package could’ve traveled from (surely we aren’t the only ones), this may give you some clarity on the locations and sizes of some of the new warehouse construction. Additionally, it shows the impact of these giant buildings on employment.

—

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.