With the dog days of summer upon us and the election ahead of us, we entered August with the expectation that the month would prove to be interesting and volatile. To be fair, the year so far has been interesting and volatile, so perhaps August will surprise us with a healthy dose of dullness. If the 2nd Quarter’s advance estimate of the U.S GDP is any harbinger of what to expect this month, however, we may be in for a bumpy and ugly ride. As Central Banks — notably the Bank of England and Bank of Japan — continue to try to stoke the flames of economic vigor, we continue to wonder when true fiscal stimulus policy will supplant monetary efforts. We continue to hear of yield-seeking investors going further out on the risk curve to meet income needs, and we shudder to think of pension plans’ funding ratios in the current debt environment. The common cure to these woes remains centered on our philosophy of doing the research, controlling the costs, and staying the course. We remind our clients that part of doing the research includes a periodic review of risk tolerance, objectives, and time horizon.

(Source: St. Louis Fed)

As the chart above shows, 2016 hasn’t been kind to U.S. growth prospects. As the WSJ points out below, consumer spending contributed to the lion’s share of positive Q2 growth. Businesses continued to be reluctant to invest (we’ve heard this song before), and we suspect uncertainty in the election year is adding to the muted corporate growth outlook. The change in inventories continued to drag on growth, but we’ve heard some spin that businesses are finally working through excess inventory, so a strategy of hope remains in effect for the final half of the year. As an aside, the ratio of personal consumption to GDP is at its highest level since quarterly GDP data was introduced in 1947. It’s currently sitting at 69.3% of GDP, and there’s not much room left to run to the upside.

(Source: The Wall Street Journal)

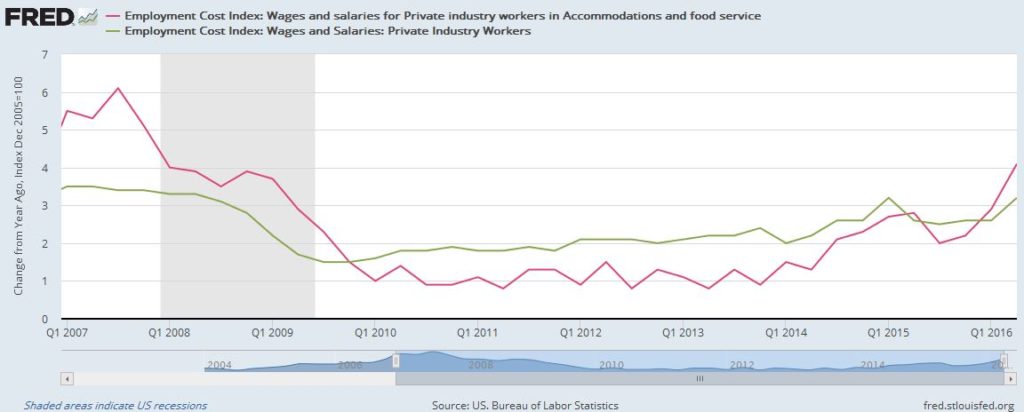

Turning to the labor market (aside from July’s huge upside surprise), the second quarter saw upward pressure on wages and salaries.

(Source: Econoday)

Regional minimum wage increases have certainly helped workers in Accommodations and Food Service:

(Source: St. Louis Fed)

As wage inflation picks up, we’ll have to see what the impact to corporate margins is over the remainder of the year. As the fine folks who compile the Daily Shot recently pointed out, this “[suggests] more pressure on margins unless companies can raise output prices.”

On a totally different note, if you’re wondering where all the jobs are being created, here’s a look of Amazon’s labor base as reported in their earnings releases:

(Source: Geekwire.com)

Switching to the energy markets, the supply side of oil continues to look ugly. It is interesting to note the recent decoupling between oil and equities, as the broad market marched higher despite the beating oil has taken. Oil supply remains elevated relative to last year and the 5-year range, although fundamentals are only part of the puzzle when looking at the current price of oil…

(Source: The Daily Shot)

We close with a recent business expectation survey from the UK and the accompanying economist viewpoint from Markit (which compiles the survey). The Bank of England’s recent efforts to throw the kitchen sink at the faltering post-Brexit UK economy have a lot of ground to cover to keep the train on the tracks. Corporate bond purchases were an interesting addition to the BoE’s plan, but we’ve seen lackluster results from low borrowing costs for big companies. Perhaps this time will be different. Until then, however, we’ll still be looking for the growth.

(Source: The Daily Shot)

—

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.