After 43 days of failing to move 1% in either direction, the S&P 500 index fell about 2.5% last Friday, September 9th. From a technical perspective, not much harm was done – although we would argue that after spending so much time in the doldrums, Friday’s move probably took a large toll on investor sentiment. Monday’s 1.5% jump in the index following a down move of more than 2% was one of only 9 occurrences in the last 50 years. Tuesday, September 13 saw those gains given away.

Suffice it to say that big market swings may be back in play.

Under the hood, we’re expecting more shaky ground as we continue in September, which has a historical record of being the worst month of the year for the stock market. This is in addition to the possibility of interest rate hikes, central bank capitulation, a presidential election, and cross-asset contagion:

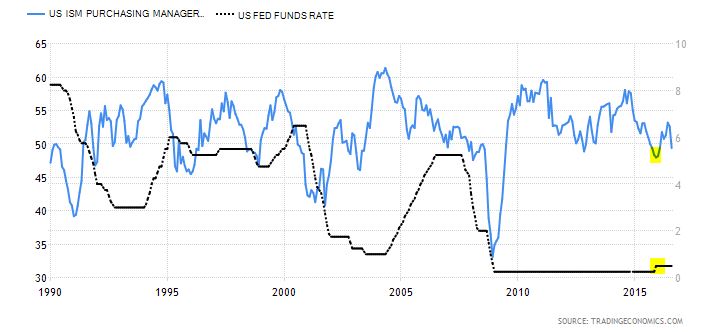

1. Federal Reserve actions. The Federal Open Market Committee meets on September 20th and 21st. We’ve seen mixed messages as to the committee’s willingness and urgency to raise interest rates. When we look through the lens of history, the Fed has only raised interest rates one time since 1990 when the U.S. manufacturing purchasing manager’s index (PMI) was below 50. That one time was last December, and we needn’t remind you what the markets did over the next 2 months. Currently, the PMI stands at 49.4 for the month of August, which will be the most recent PMI data the Fed will take into its meeting. Of course the Fed will take much more data into account, but the fact that the markets are largely ignoring the possibility of a rate hike reminds us of the disbelief heading into Brexit.

(Source: Tradingeconomics.com)

2. Central bank capitulation. We’ve heard recent remarks from the European Central Bank and the Bank of Japan that seem to indicate that central banks have reached the limits of monetary policy and are now concerned with the long-run implications of depressed interest rates or expanding balance sheets in exchange for very little real growth. The markets have responded favorably to central bank “easy money” actions, so the threats of reducing asset purchases and manipulating the yield curve have spooked investors.

3. The election. Although our primary focus is on the U.S. presidential election, European politics is grouped into this section of our focus also. Italy is facing a crucial referendum that may open the door to more questioning of the legitimacy of the Eurozone. Even though the markets and the economy tend to influence elections more than the other way around, an unexpected lead in the polls (or a change in the Democratic ticket) may reverse that precedent.

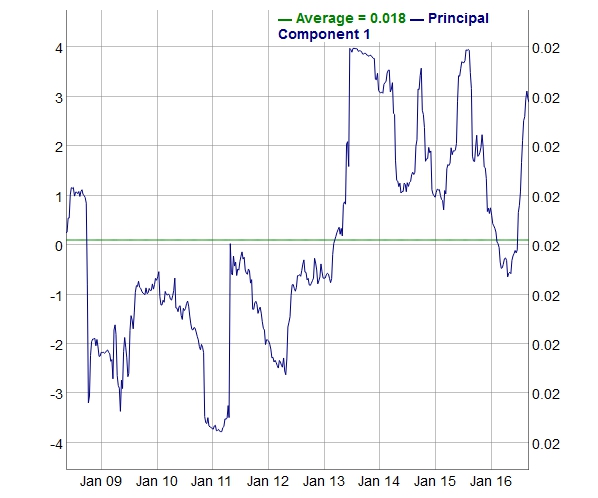

4. Cross-asset contagion. While the name sounds infectious, we’re merely referring to the fact that correlations among assets have marched towards 1; that is, assets start moving together (usually down) when volatility shows up in the markets and there are pullbacks from recent highs. We use a technique called Principal Component Analysis over a rolling 6-month period to identify factors that explain returns across asset classes (stocks, bonds, currencies, precious metals, and commodities). Usually these are well-diversified assets and can be used to construct robust portfolios. However, bond buying programs by central banks, investors piling into risky assets looking for yield, and currency volatility have driven this common factor to its highest level in over a year, and significantly above its average since 2008. This often results in assets moving together that shouldn’t typically — like stocks and bonds.

(Source: Targeted Wealth Solutions)

The bottom line: Understanding and quantifying your risk tolerance is an important weapon against emotional investing. Short-term volatility can shake even the most confident investor, so we want to make sure that our clients know the risk landscape that’s out there. If you have any questions, please give us a call at 1.888.832.4939.

—

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.