We recently spent some time on the other side of Colorado (where some clients call the “right side of the Rockies”) in an area dominated by commercial agriculture and historically economically reliant on energy and mining. Our trip reminded us of a often-overlooked economic report whose methodology is explained below:

Each month, community bank presidents and CEOs in nonurban, agriculturally and energy-dependent portions of the 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included.

This survey represents an early snapshot of the economy of rural, agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.

(Source: Mainstreet Economy – Creighton University)

One limitation — in our opinion — is that the survey doesn’t actually include data from producers; rather, it’s from the perspective of the financial engines that drive the rural economies in the aforementioned areas. Perhaps this purposeful data exclusion is designed to eliminate some of the noise of subjective responses, and we’ve found that the report’s outlook and commentary echoes with owners/operators in the area. So with all that said, we think it’s a pretty robust report on a segment of the American economy that’s often overlooked by the majority of folks.

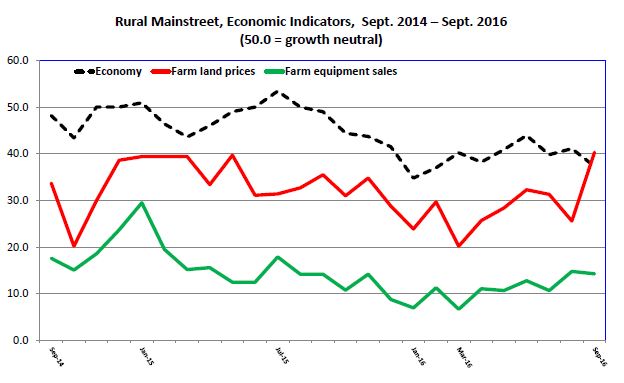

Summing the various metrics used in the survey, the report highlights a “Below Growth-Neutral” standing for September 2016:

(Source: The Mainstreet Economy Report)

The components of the survey include a broad economic index, loan volumes, farm land prices, and hiring, to name a few. Compared to a year ago, the “Economy” indicator (black dashed line above) is significantly below its prior year reading of 49. Here in Colorado, however, the picture was a little brighter, with farmland prices and hiring both increasing from the August readings.

Obviously rural mainstreet has some headwinds, especially with broad commodity prices stalling out (specifically corn, wheat, and crude oil)…

In other news-

The Atlanta Fed’s Hourly Wage Tracker shows median wage growth ticking higher:

(Source: Atlanta Fed)

Consumer spending remains healthy, and as the largest contributor to GDP (personal consumption), that’s an important factor to consider. Wage inflation is already causing some concerns in the leisure and hospitality industries, with companies competing for the same pool of workers and finding difficulties passing price increases on to the consumer.

We continue to see the same sluggish growth out of the U.S. economy, although the election is adding some volatility and noise to the market… if the Black Swan event occurs (a GOP victory based on the market’s expectations), then we may see downside risk increase as the U.S. — and the world — begin to digest what that presidency would look like for global trade and foreign relations. The October monthly outperformance of dividend paying stocks (even in the face of interest rate hikes) over non-dividend paying (growth) stocks reinforces the same story of investors paying a premium for current income in a yield-depressed environment. Growth struggled in October, although the month was really an opportunity for investors to lighten up their U.S. equity exposure.

—

Mention of products, providers, or services does not constitute an endorsement or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.