In lieu of an image of the presumptive President-elect tearing his shirt, we’ve decided to rely on the classic “Hulkamania” mental picture. It’s probably best left that way.

Nevertheless, the relentless skyward movement of U.S. stock indexes and the concurrent pummeling of the bond market have certainly created an environment unlike anything we’ve seen since the Global Financial Crisis; that is, the prospects of stimulative fiscal policy, inflation, and improved growth have continued to show up in investment ideas and portfolio positioning since the election. Like any good professional wrestling match, there’s a clear winner here and fixed income appears to be on the ropes. But… like any good professional wrestling match, there may be surprises ahead…

However, we will admit that the market is right — up until the point that it’s not. The first 100 days of Mr. Trump’s presidency will either validate the market’s expectations of growth and inflation, or those days will see an unwind of the Trump trade that we’re witnessing at the moment. Most big-name investors agree that the bond market’s 30+ year rally is over, but that statement is overly simplistic and devalues the diversification benefits of an asset group other than U.S. small caps (the big winners of the Trump trade currently). Here’s the Russell 2000’s (U.S. small cap stocks) upside explosion since the election:

(Source: Stockcharts.com)

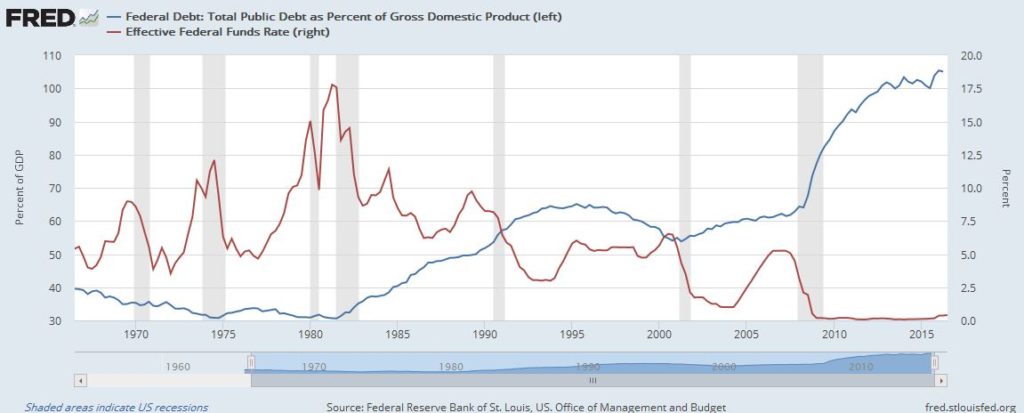

We’ve seen some “retrograding” of rhetoric since Mr. Trump claimed the victory, so it will be interesting to see what parts of his platform will fall by the wayside next year. In the meantime, we continue to hear that Mr. Trump’s major economic policies will pass through the Republican Congress without too much of a fight. The rotation into risk assets certainly supports this notion; however, we’re a little more skeptical about front-running political processes. If you’re inclined to compare a Trump presidency to Reagan’s time in office, we’d like to point out that the starting conditions are wildly different today than in 1981:

(Source: St. Louis Fed)

First off, the blue line (left hand axis) shows the total public debt (the amount owed by the U.S. government) as a percentage of Gross Domestic Product. This is a good way to visualize the leverage of the economy, and as the chart points out, our obligations are much higher now as a proportion of our GDP — especially since the days of Reagan. Secondly, the Federal Reserve has very limited “ammunition left in the locker” when it comes to interest rate flexibility in the face of recessions. The red line shows the effective Federal Funds Rate — or the rate the market refers to when it talks about raising/lowering rates — and you can see that a prime weapon against recessionary forces is a lower effective funds rate. When you start close to zero, you have very little latitude to maneuver before something breaks or you find yourself out of options.

This is all to say that there are economic challenges present that could serve as potential roadblocks to Mr. Trump’s plans. This is also assuming the Republican Congress stands behind him. With fiscal conservatism still strong within the rank and file of the GOP, there may be some headwinds for Mr. Trump’s infrastructure spending plan (that would inevitably benefit U.S. manufacturing and industrial companies).

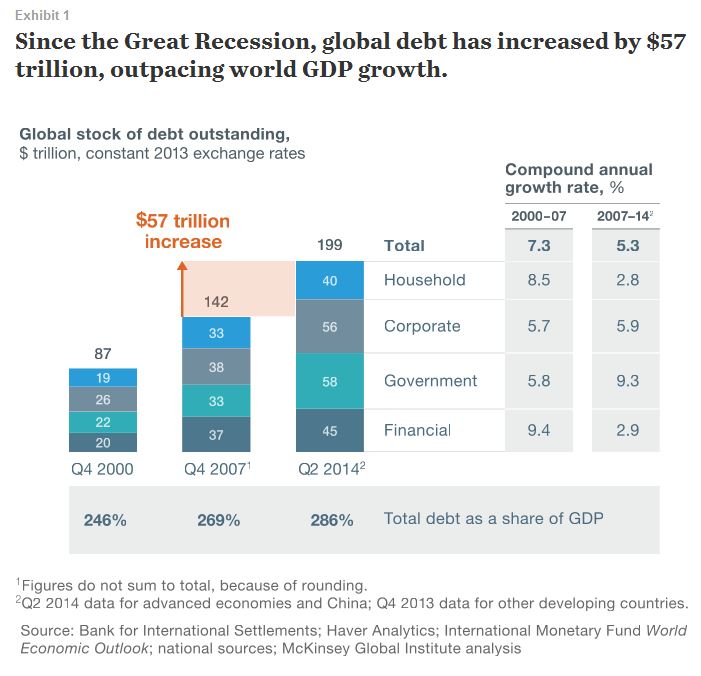

The leveraging of the economy has been restricted to the U.S., either:

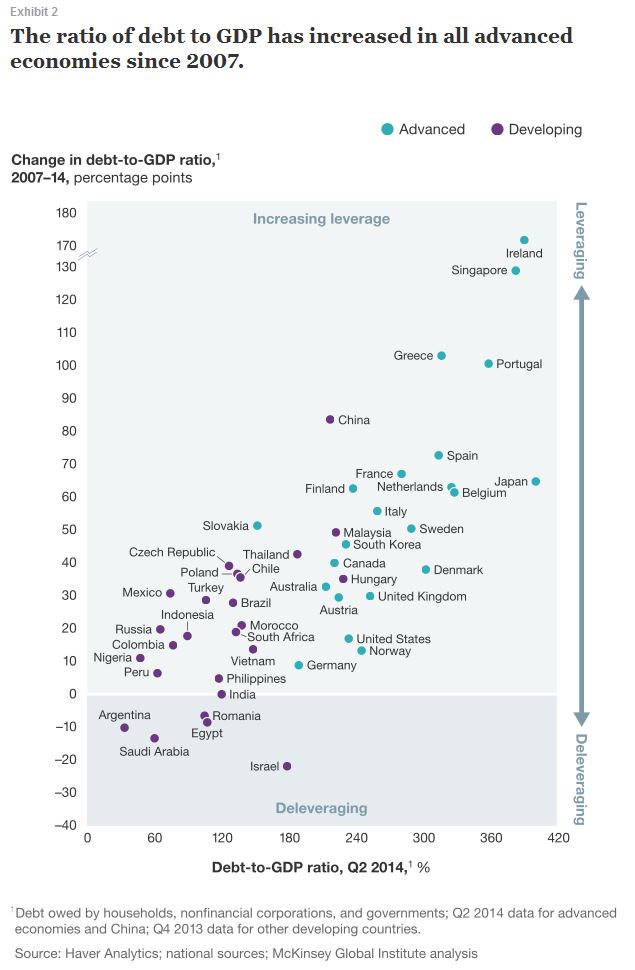

In fact, the debt-to-GDP ratio has increased in every advanced economy since 2007:

(Source: McKinsey & Company)

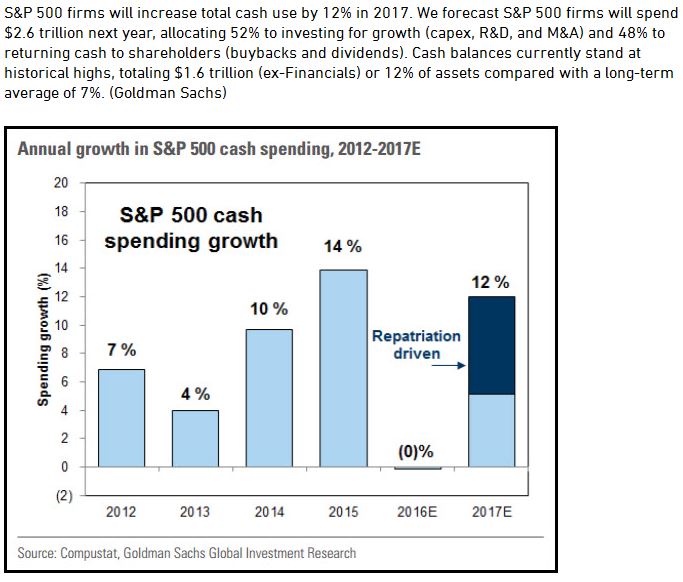

We’ve seen big companies like Ford and Apple start exploring U.S. manufacturing options, so the Trump trade expectations are being evaluated in the real economy as well. Throw in the expected cash repatriation and spending by S&P 500 companies looks like a bright spot (according to Goldman Sachs):

(Source: GS GIR)

Clearly there are opportunities for risk assets to capture more upside, but as of right now there’s little concrete evidence to support the assertion that Mr. Trump’s economic platform will be victorious — even with a Republican Congress. Mr. Trump will enjoy executive powers that will help his cause, but true and meaningful reform (especially concerning tax and fiscal stimulus) will require some sort of Congressional help. We will have to wait and see how that political wrestling match ends.

—

Mention of products, providers, or services does not constitute an endorsement or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.