We had a tough time coming up with a title for this post… the runner up was: “No, Mr. Bond. I expect you to die!”

At the end of the day, however, we felt the line from Goldfinger was a little too aggressive. Instead, we went with a concept from our days of flying low and fast. A box canyon according to Mr. Webster is “a canyon with approximately vertical walls and typically closed upstream with a similar wall.” A box canyon (that is, an unforeseen dead end) according to a pilot is a bad place to be. You probably don’t have enough lateral room to turn around, you might not have enough time to react and climb, or you might not have the thrust to make it out of the canyon. It’s a tight spot to be in, and it’s why we always were very meticulous when planning low-level flights — especially in canyons. After all, the ground has the highest probability of kill (Pk) out there.

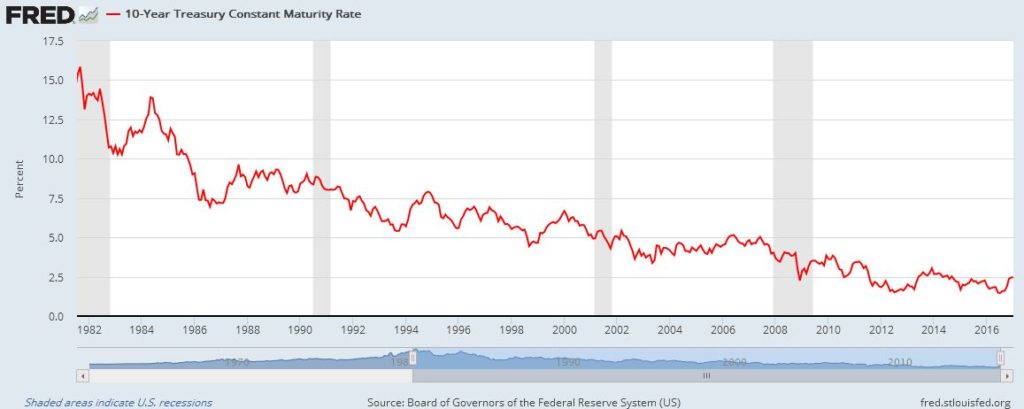

We see a similar peril of arbitrarily loading up on bond exposure in an environment clouded with monetary and fiscal policy uncertainty. Of course, our analysis would be incomplete if we didn’t factor in an aging U.S. population and an unsteady political landscape. Since the election and December rate hike by the Fed, yields on the 10-Year U.S. Treasury have moved about 61 basis points (100 basis points = 1 percent). As yields rise, bond prices go down. If you had an exposure to intermediate or longer-term Treasuries in your portfolio, you may have noticed a surprising decline in those positions. Even broad indexes like the Bloomberg Barclays US Aggregate Bond Index took a hit… although that’s not surprising given that nearly 40% of the index is made up of exposure to U.S. Treasuries.

(Source: St. Louis Fed)

A yield of 2.6% on the 10-Year has been called “the start to a secular bond market” according to Bill Gross. Looking at the long-term chart of 10-Year yields, we can see where he’s getting his number:

(Source: St. Louis Fed)

The recent political uncertainty notwithstanding, the 10-Year already has a potential 15 basis point increase courtesy of the declining maturity of the bonds held by the U.S. Treasury. Janet Yellen had a footnote buried at the end of her January 19th speech. To wit:

17. Based on estimates generated using the term-structure model developed by Li and Wei (2013) and the procedure discussed in Ihrig and others (2012) and extended by Engen, Laubach, and Reifschneider (2015), the Federal Reserve’s holdings of Treasury securities and agency mortgage-backed securities continue to put considerable downward pressure on longer-term interest rates. However, this pressure is estimated to be gradually easing as the average maturity of the portfolio declines and the end-date for reinvestment draws closer. Over the course of 2017, this easing could increase the yield on the 10-year Treasury note by about 15 basis points, all else being equal. Based on the estimated co-movement of short-term and long-term interest rates, such a change in longer-term yields would be similar to that which, on average, has historically accompanied two 25 basis point hikes in the federal funds rate.

(Source: Federal Reserve)[emphasis ours]

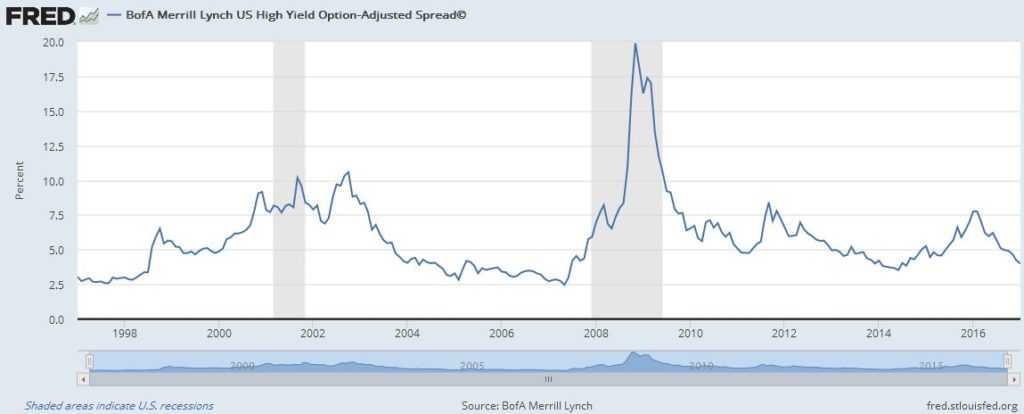

Should you give up on bonds? In a word, nope. High yield is still showing signs of life (evidenced by compressing spreads):

(Source: St. Louis Fed)

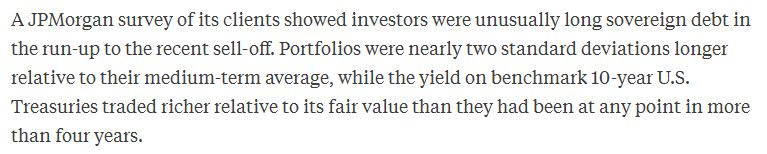

As spreads tighten, prices go up, which if you had exposure to “junk” bonds in 2016, you’re probably already aware of this. From a historical perspective, spreads still have room to run… and since the high yield market often turns sour before the stock market, some investors are going to be watching for a sharp reversal of spreads before bailing out of stocks. Additionally, the sharp selloff of Treasuries last fall was exacerbated by overweighting in portfolios:

(Source: Bloomberg)

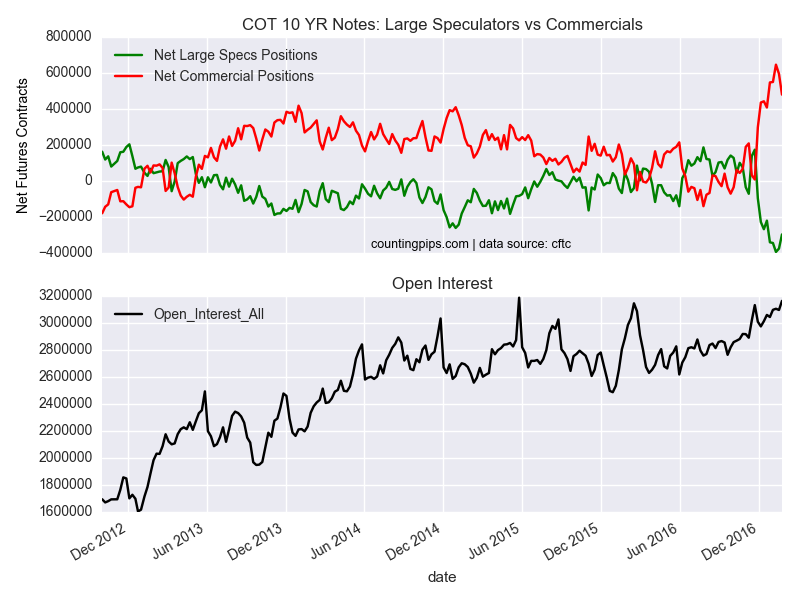

The flip side has emerged: speculative short positions on the 10-year hit a record, although these bearish bets have backed off recently:

(Source: CountingPips)

As inflation expectations grind higher, yields will follow. As monetary policy normalizes (tightens), yields will creep up. Uncertainty and flight-to-safety should have the opposite effect: as investors jump out of stocks amid a perceived crisis, they will look for safety in Treasuries. This will have a downward pressure on Treasury yields. The purpose of fixed income in a portfolio should be three-fold: income, stability, and diversification against riskier assets. Limiting duration and tilting into sector exposures may open up opportunities for income, stability, and diversification that are tough to find in a generic bond index right now. Alternative credit strategies — in our opinion — have yet to find their footing, but there are some solid options when it comes to active bond investments. We tend to favor active bond strategies over passive index exposure (a complete departure from our standard equity viewpoint), and we view it as analogous to meticulous mission planning to avoid a box canyon. Active comes with a cost and a risk, though, as fees are higher than a passive broad index and overweighting certain sectors could lead to instability (read: volatility) depending on where a market risk event starts and contagion spreads.

Bonds provide a beneficial balance to a portfolio, but it may be worthwhile to spend a little time digging under the hood of your fixed income exposure to see where you sit in duration, quality, and sector. Until Washington backs out on its promise to stoke growth with fiscal policy, inflation expectations should continue to rise… with a tightening monetary response (all things being equal). The “reflation” trade has an impact on bonds, and it may be time to do a little mission planning to avoid the bond box canyon.

—

Mention of products, providers, or services does not constitute an endorsement or relationship.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Targeted Wealth Solutions LLC is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Targeted Wealth Solutions LLC.